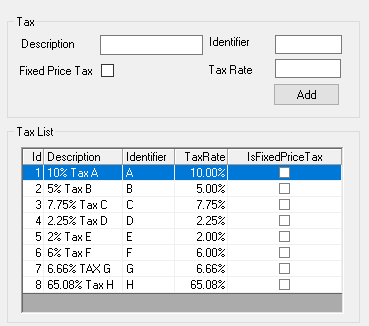

Tax Plans Tab

The Tax Plans Tab is used for setting up State or Local Taxes.

You can set up an unlimited number of Tax Plans. This is especially useful for companies with stores in multiple states.

- Enter the Description of the tax, such as 5% Tax A. This will be printed on the Receipt and used in Reports.Tax_Plan_2

- Enter the Identifier. This is printed on the Receipt to the right of the price.

- Enter the Tax Rate.

- If using a Fixed Price Tax, flag this box. This will apply the same tax to a product regardless of the price of hte product.